More than 52% of Singaporean couples are dual-income, and some of them – especially when they have young or elderly at home – may have or are considering hiring a domestic helper to assist in household chores. Letting a domestic helper be part of your household is a new relationship between your helper and your family, and beyond building mutual trust and ensuring your helper’s welfare, you’re responsible of insuring and paying her.

For your helper – especially if she’s new to Singapore – there are many things to do, from receiving her monthly salary, keeping in touch with family and friends, to sending money home.

Singtel Dash – all-in-one mobile wallet for employers and their helpers

We understand parents have a lot on their plate on top of your work and personal commitments. We’re pleased to introduce Singtel Dash – the all-in-one mobile e-wallet that lets you pay, remit, save and insure from one app. Here’s how the app can help you minimise the administrative steps without compromising security so you can focus more on spending quality time with your family:

1. Use Singtel Dash to transfer salary to your helper

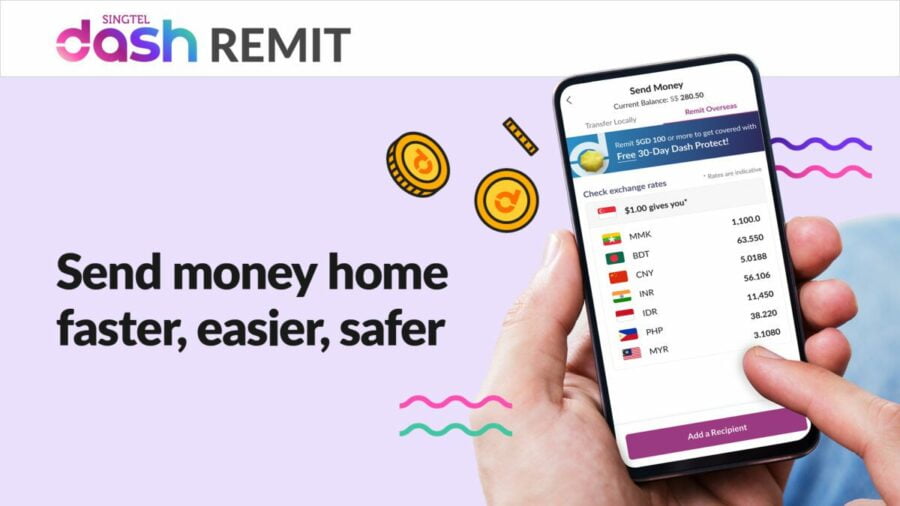

With Singtel Dash, you can make transfers in seconds. Employers can transfer salary to their helpers easily and instantly. Your helper is no longer required to queue for long hours at remittance shops. This will lessen COVID-19 risk exposure too! With Dash Remit, your helper can send money overseas anytime, anywhere with her phone in a faster, easier, and safer way.

As an employer, you can assist your helper to remit money home by transferring an agreed portion of your helper’s salary to her Dash account. She can then use the money in her Dash wallet to remit money back to her home country. The transfer process for employers to helpers is via ‘Remit’ route on the app (if employer chooses to transfer via Dash to Dash), or with PayNow.

This can be done in 3 simple steps:

1. Download Singtel Dash

2. Complete the simple digital self-registration through the app

3. Transfer via Dash, or top up helper’s Dash wallet through PayNow

Not yet a Dash user? Get up to $20 cashback when you sign up

Sign up for Dash with the referral code ‘SUPERMOM’ and you get up to $20 cashback when you make the eligible transactions by 31 December 2021.

More details on dash.com.sg/new-user. T&Cs apply.

With the Dash app at your helper’s fingertips, it is truly a convenient choice to e-remit money back home, thus avoid crowds during the pandemic.

Advantages of using Dash

- Helpers can take their rest days at home to avoid the spread of the virus

- Aligned with MOM advisory, employers are encouraged to pay salaries electronically and directly into helper’s bank account to facilitate your helper to use e-remittance options

- Some helpers may not understand local languages, and may require help from their employers to guide them on the process of e-remittance. With Dash, the user-friendly interface and simple steps required to make transfer, your helper can easily pick up from the get-go.

Rest assured, Singtel Dash is licensed by Monetary Authority of Singapore (MAS). Transactions within the Dash app is secure. The Dash app is protected with a 6-digit PIN and a One-Time Password (OTP).

It is also widely accepted in seven countries to remit to, and friends/family back home can receive via mobile wallet, bank account or cash at selected cash pick-up points. The seven countries available for money remittance are Bangladesh, China, India, Indonesia, Malaysia, Myanmar, and Philippines.

Other benefits include:

- Enjoy competitive exchange rates when you remit money

- Transparency in pricing policies: No Hidden Fees

- Open to all local (you don’t need to be a Singtel mobile subscriber to use Dash!)

- Complimentary FREE* 30-Day Dash Protect, free personal insurance coverage for 30 days!

Refer and get a $5 SuperMom voucher

Refer your helper to make her first remittance with Singtel Dash Remit before 31 December 2021 to get your voucher. Simply fill in this form and be the first 100 qualifying referrals.

Your helper gets SGD10 cashback on her first 2 remittances of minimum SGD100 each (excluding fees), earn 50 Dash reward points for each remittance, and a FREE 30-day Dash Protect insurance from Income too.

Refer now at dash.com.sg/remit/refer

2. Get the most affordable maid insurance on Singtel Dash

Buying a maid insurance is probably the first few things on your to-do list since it is mandated by MOM. You can now do so within the Singtel Dash app.

The ePROTECT maid insurance from Tiq by Etiqa not only gives adequate coverage for your helper, but also protects you financially as an employer, including termination and re-hiring expenses. It is also the most affordable maid insurance in Singapore, starting from S$138.42 (based on Plan A, 14-month coverage).

Additionally, the insurance plan also offers FREE Financial Assistance Benefit for side effects of COVID-19 Vaccination for your helper.

SAVE 25% & EARN 2,000 Dash reward points when you buy maid insurance!

From now till 31 March 2022, purchase ePROTECT maid insurance from Tiq by Etiqa Insurance via the Singtel Dash app or dash.com.sg/insurance to enjoy 25% off and get 2,000 Dash reward points.

Enjoy other benefits and savings with Singtel Dash

Besides being a nifty app to manage your helper’s insurance and money matters, Singtel Dash also offers deals and products that help you save in your daily purchases.

- Save at up to 1.5% p.a. returns with Dash PET by Etiqa Insurance

- Exclusive deals are updated regularly here

- Get extra 1GB mobile when you pay for your Singtel mobile bill (terms apply)

- Earn unlimited Dash reward points to redeem for useful vouchers

ENJOY $10 off ALL SuperMom purchases when you cart out with Dash

From now till 31 December 2021, simply pay with Dash for your purchases of minimum $150 at supermom.com and key in promo code: SMDASH10 to unlock this promo. Limited to first 200 redemptions only! T&Cs apply.

Find your 16-digit Visa Virtual Card number on the Dash app to make all your online

purchases seamlessly.

Disclaimers:

* For the first S$10,000 Account Value: 1.3% p.a. for the first Dash PET policy year. For above first S$10,000 Account Value: 0.3% p.a. for the first policy year. Crediting rate is non-guaranteed. Additional 0.2% p.a. to the existing 1.3% p.a. returns for your first S$10,000 Dash PET savings during the first policy year while the complimentary protection is active.

ePROTECT maid insurance and Dash PET are underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. Protected up to specified limits by SDIC.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 1 December 2021.